UNIQA. Medical insurance calculator

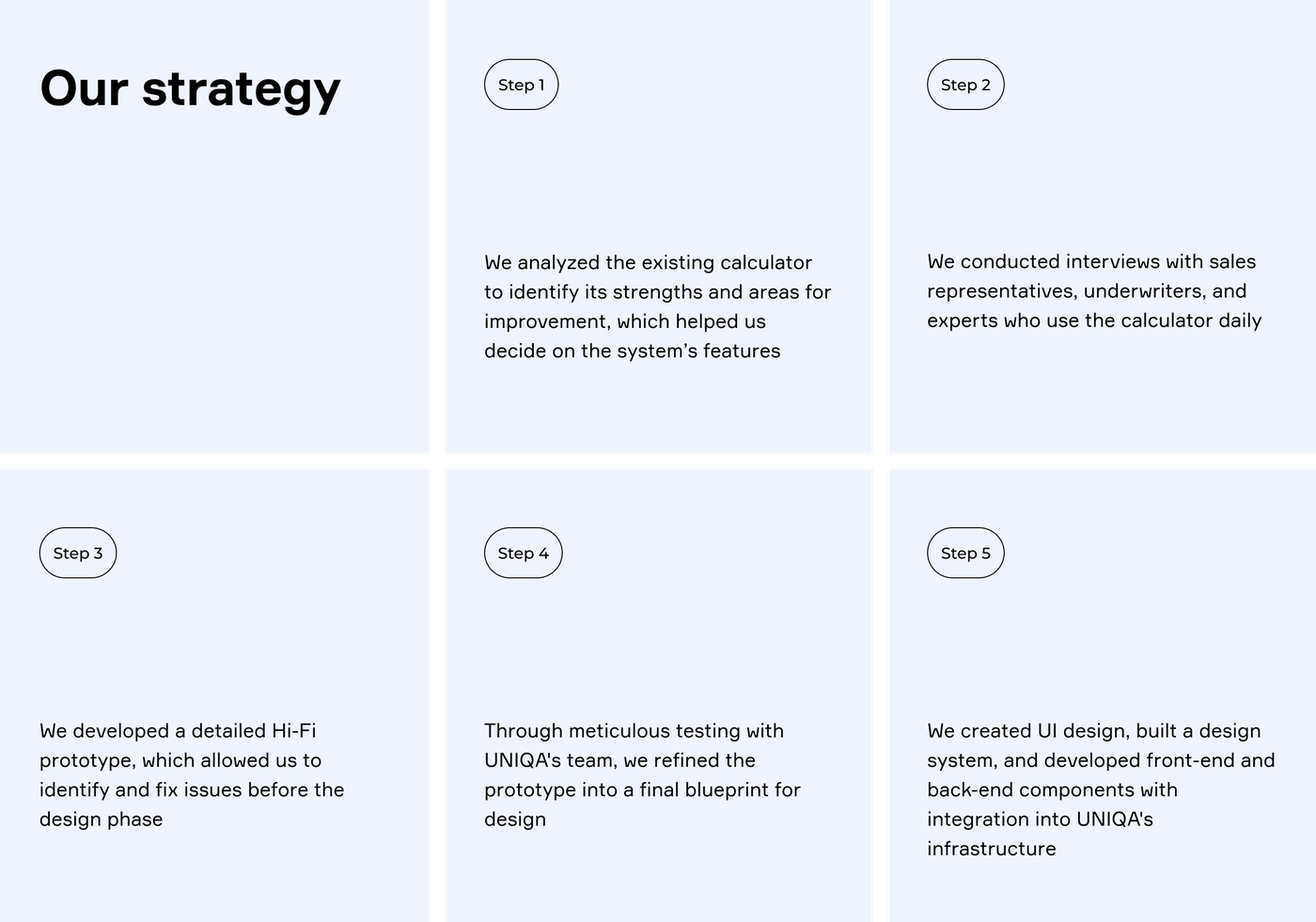

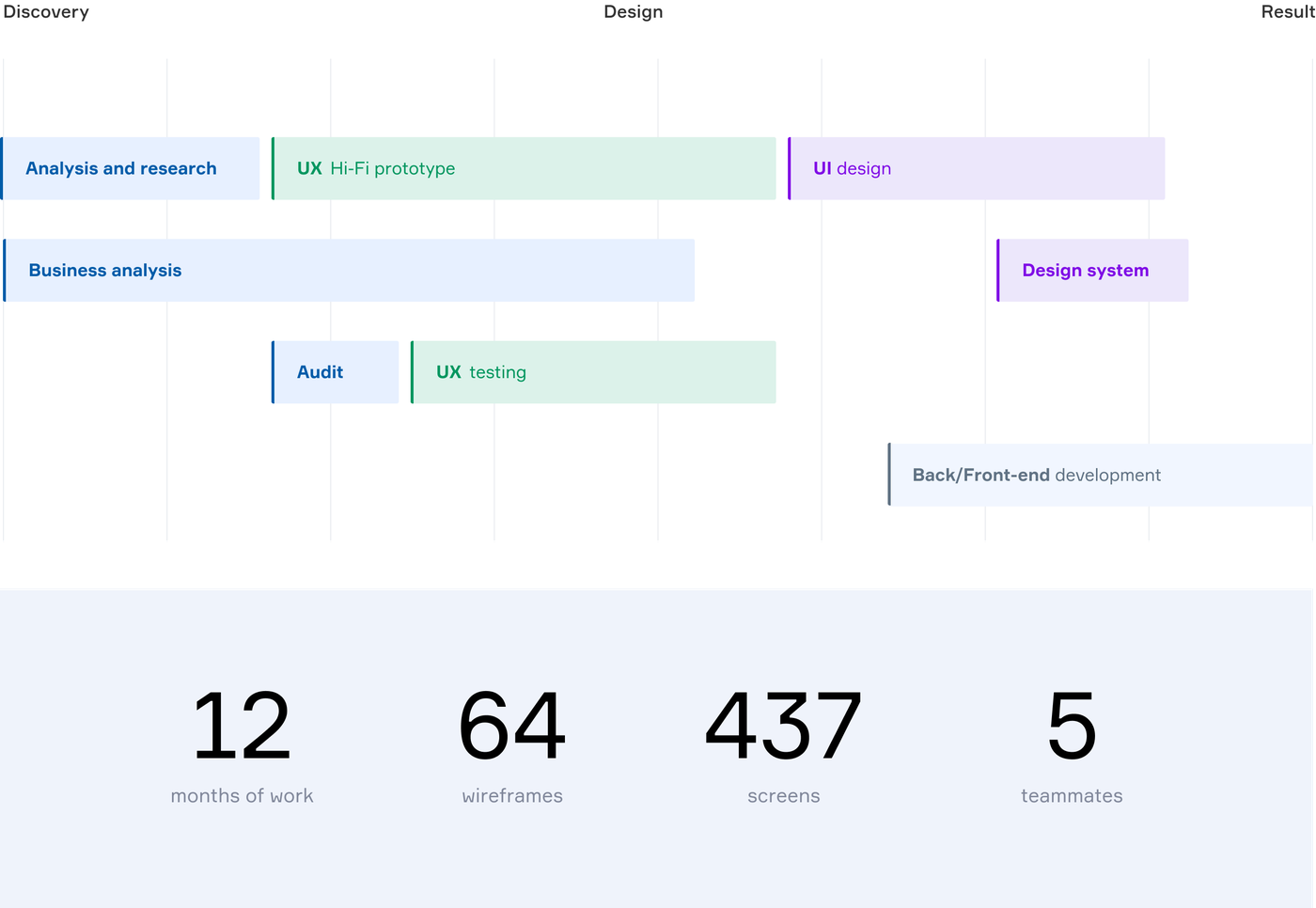

When UNIQA insurance company turned to Brights, its team was already using a calculator for medical insurance quotes, but it wasn't keeping up with their growing needs. UNIQA required a smarter solution. So, we developed a comprehensive system that streamlined how their experts analyze and compare insurance plans, making the entire process both faster and more precise.

About the client

UNIQA is part of UNIQA Insurance Group, one of the leading insurance groups in Austria and throughout Central and Eastern Europe. Over the years, the company has earned clients' trust across all insurance sectors.

For calculating medical insurance policies, UNIQA uses an internal calculator — a specialized tool that helps insurance professionals analyze, compare, and plan policy coverage, focusing on the most beneficial plan according to request requirements. This way, the policy buyer can get an accurate estimate of the premium they will need to pay for a specific coverage amount. And that’s exactly what Brights set out to build for our clients.

Our primary goals

The medical insurance calculator is a comprehensive financial tool that requires a well-coordinated, structured, and flexible design system, adaptable to every need.

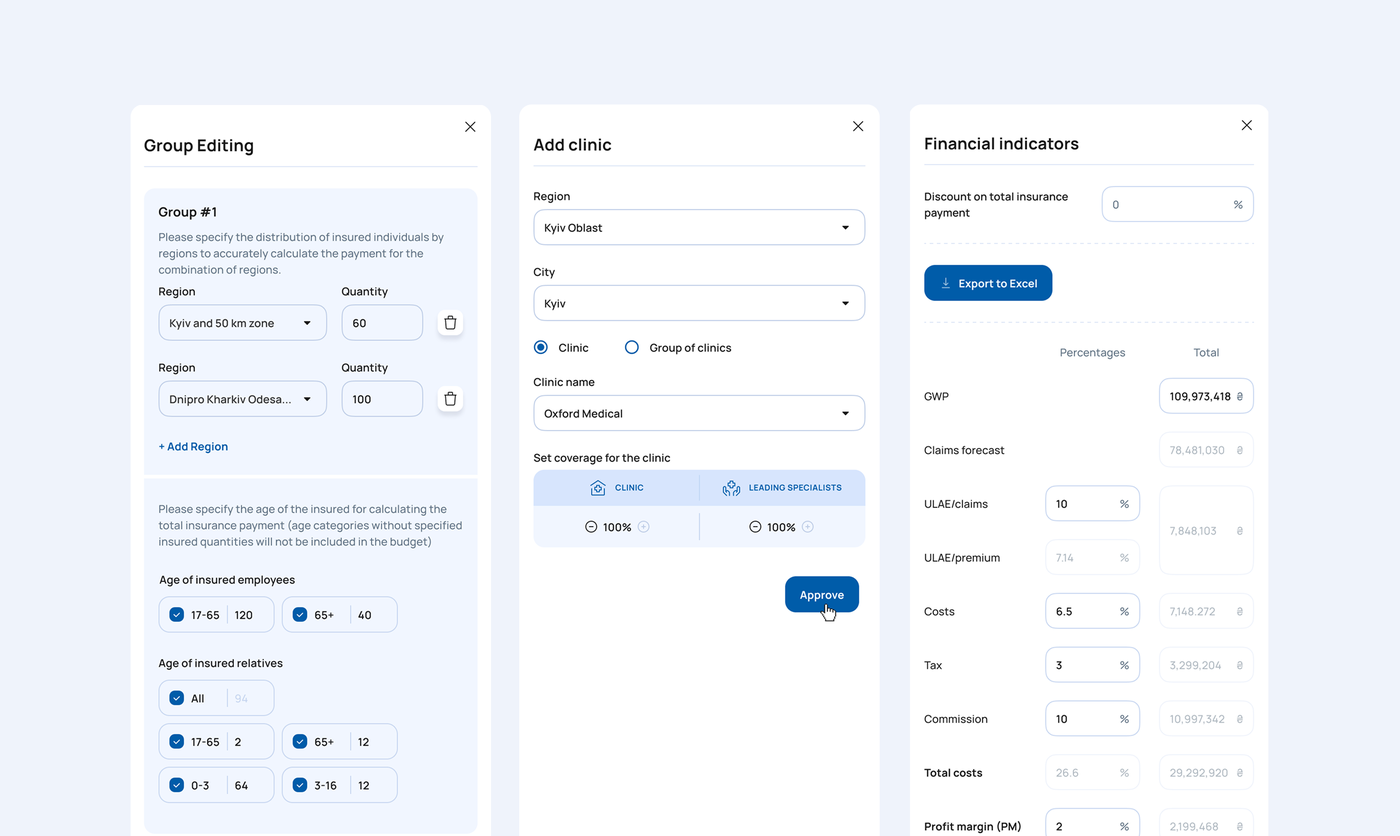

The existing solution needed significant enhancement. The calculator was expected to encompass all employee needs. Specifically, we aimed to create a universal proposal program that would cover all age groups in a single interface, eliminating the need to duplicate options for each group.

Another crucial requirement was to optimize the approval process. Insurance agents required the option of sending proposals directly to highly qualified specialists (underwriters) for review within the calculator. The goal was to eliminate the need for additional messaging apps and significantly speed up the workflow.

Timeline

Use cases

When doing research, we identified three interconnected yet distinct user roles. Each had fundamentally different needs and workflows, making their analysis crucial for our next steps.

Hi-Fi prototype

The high-fidelity prototype was tested by company employees in 4 stages to ensure everything worked flawlessly at the clickable wireframes stage. The prototype was initially developed with all functionalities and was enhanced after each testing session.

Our solutions

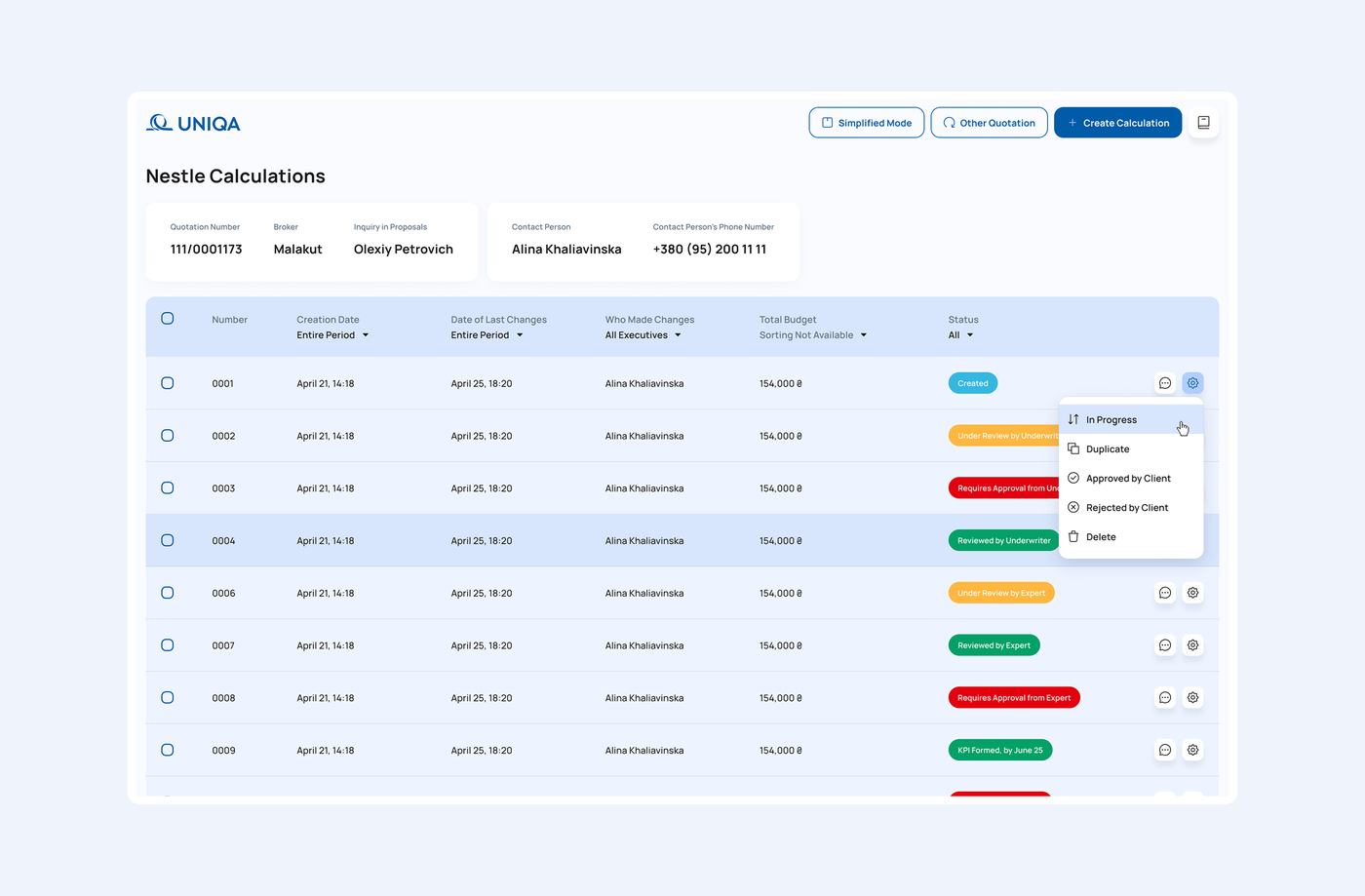

All calculations

Every insurance proposal starts with a clear overview of all calculations. Since agents often work with multiple proposals simultaneously, we created an organized system where each proposal could be managed separately.

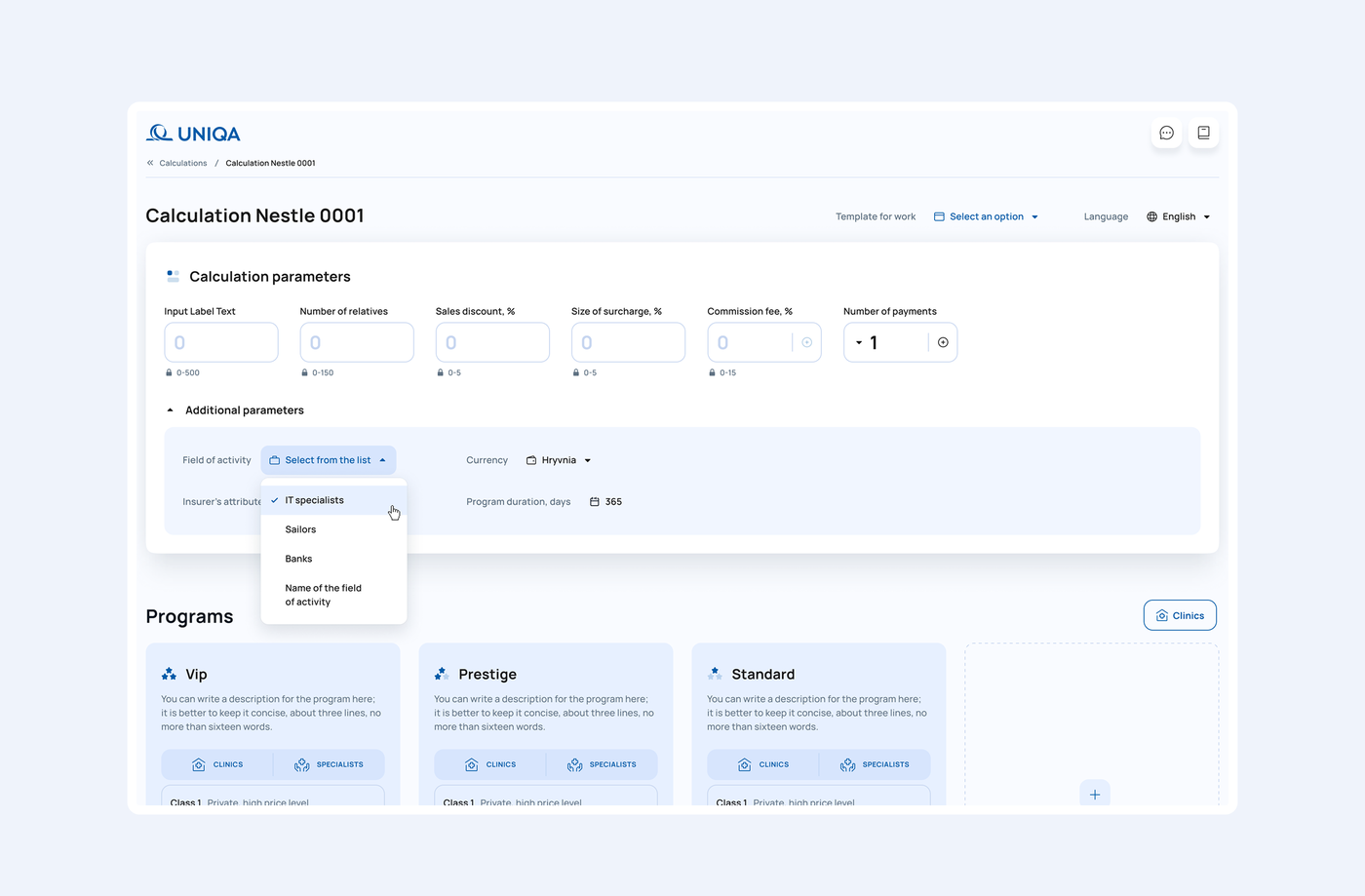

Proposal creation

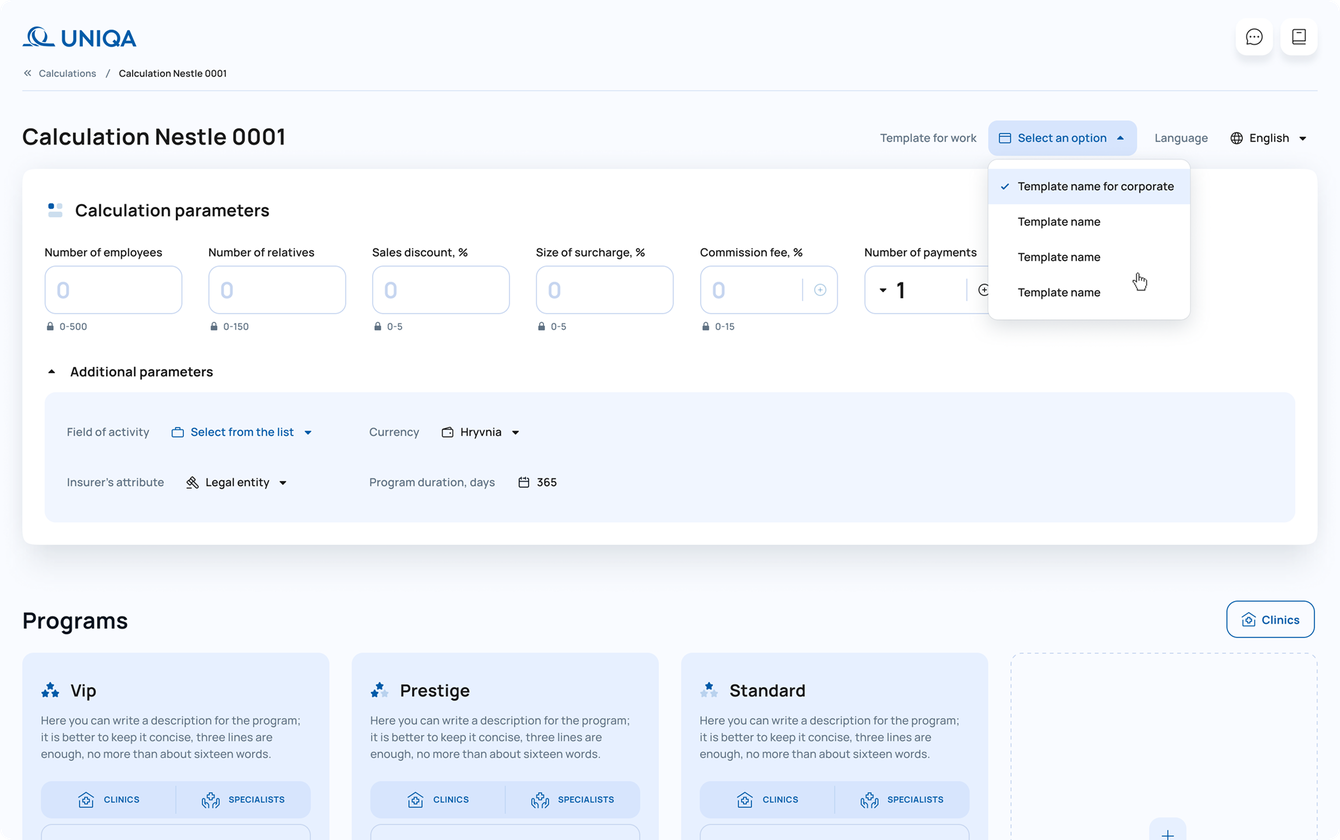

We redesigned the calculation process with clarity in mind. Each calculation has to include general information about the insured persons and their first program. We decided to separate the program selection stage from adding options, so these processes wouldn't overlap and would maintain clear, distinct functionality.

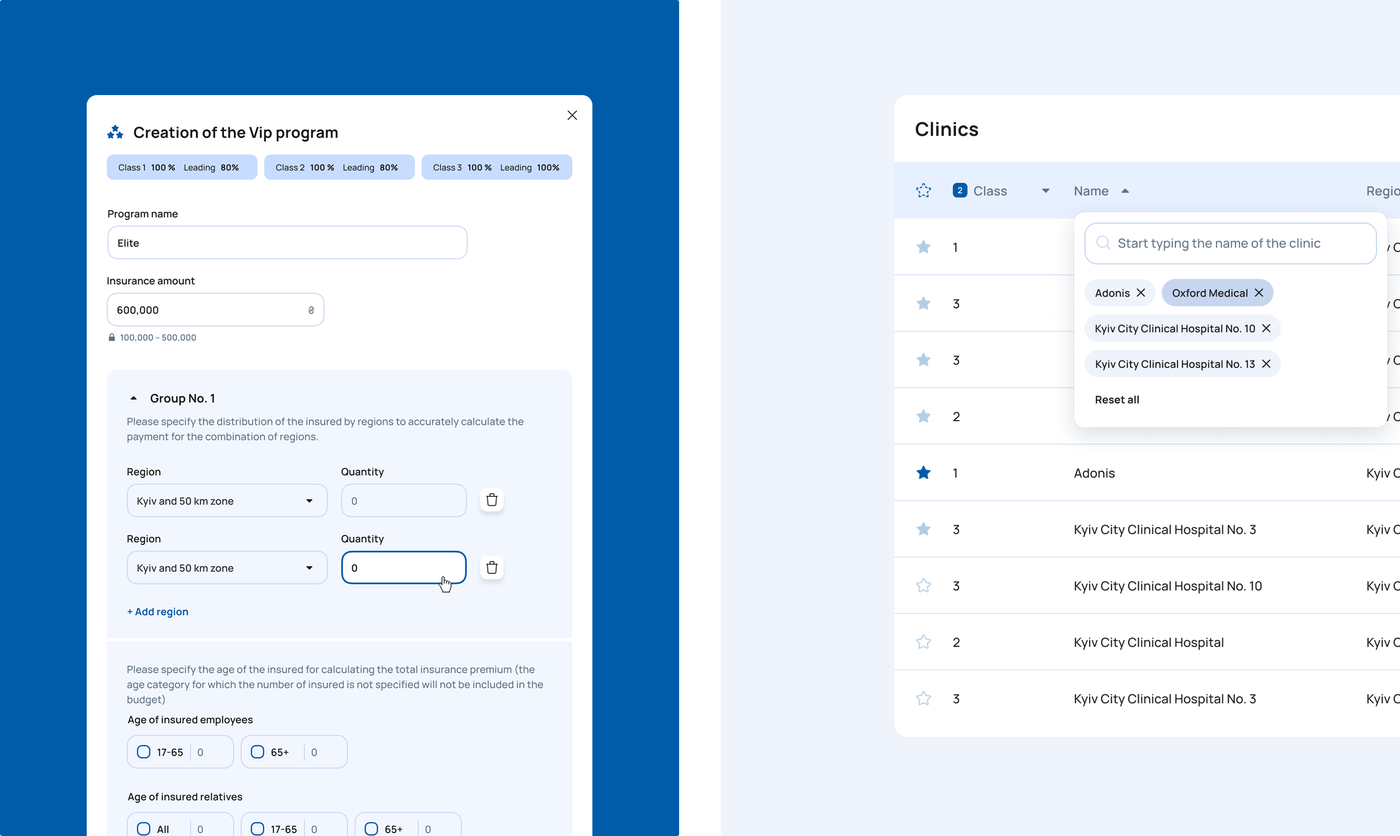

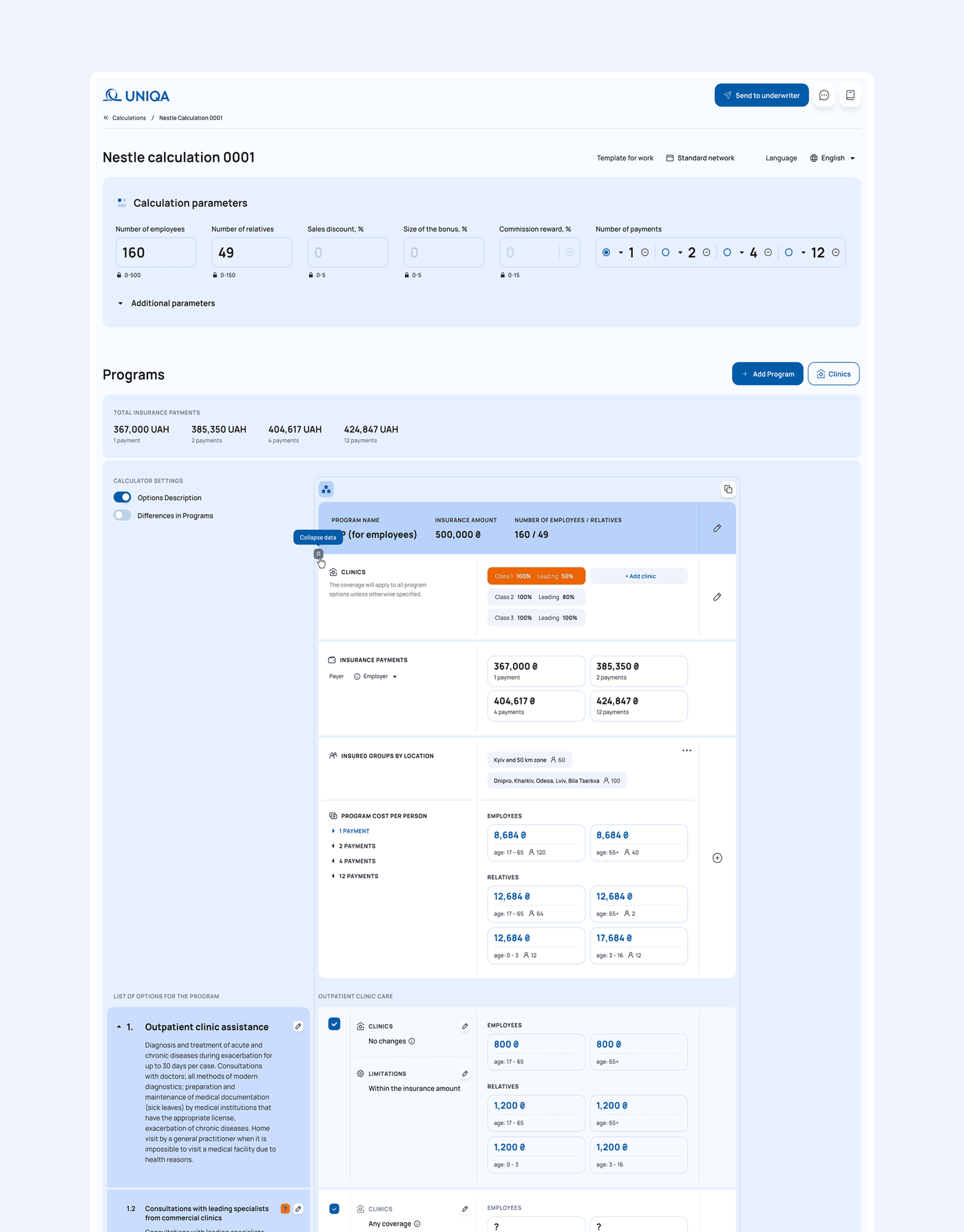

Comprehensive calculator

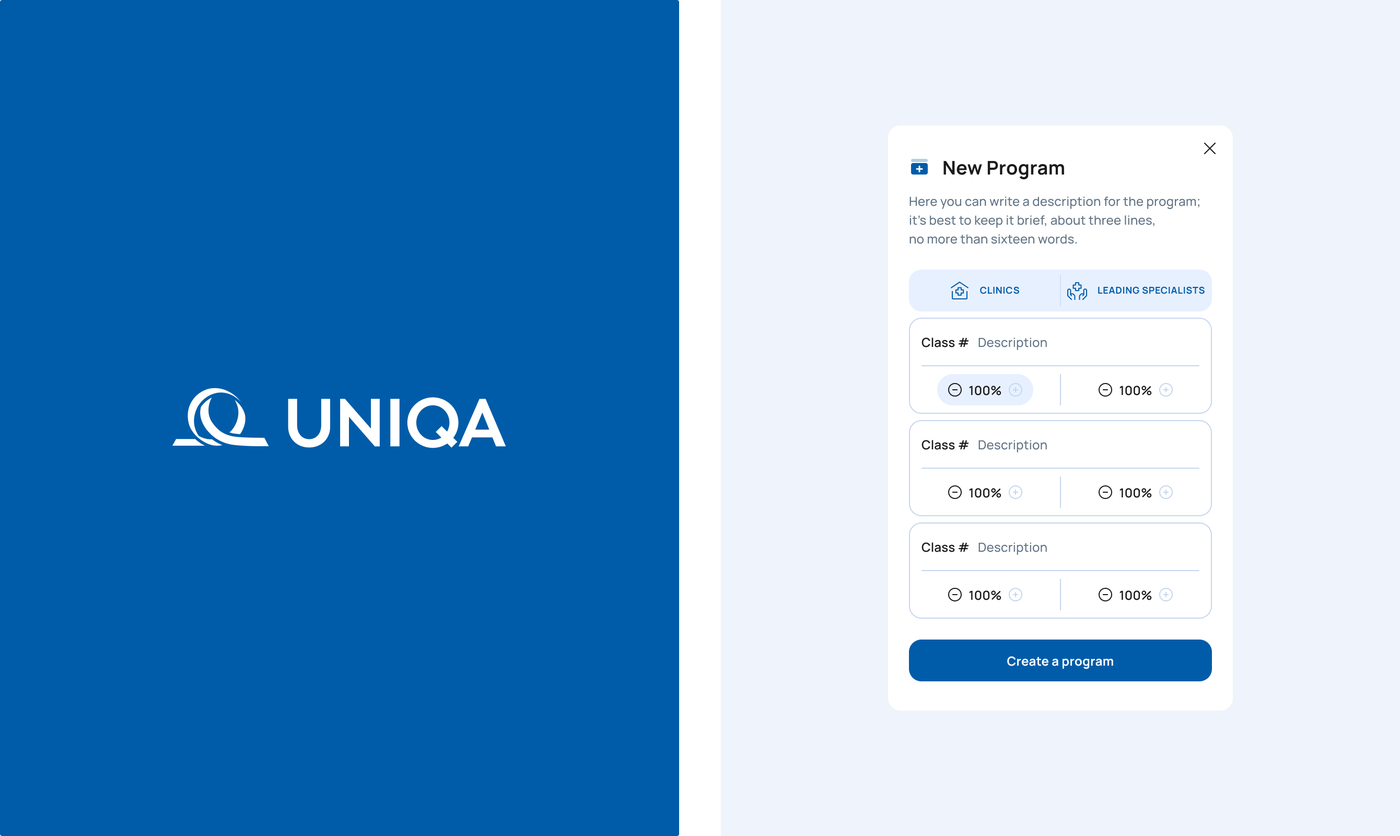

Now, to create a proposal, there's no need to add multiple identical programs for different age groups — you can simply select one program and include all age groups within it, and the prices will automatically adjust for each one. The same applies to options: each option includes all insured age groups that were selected at the beginning of program creation.

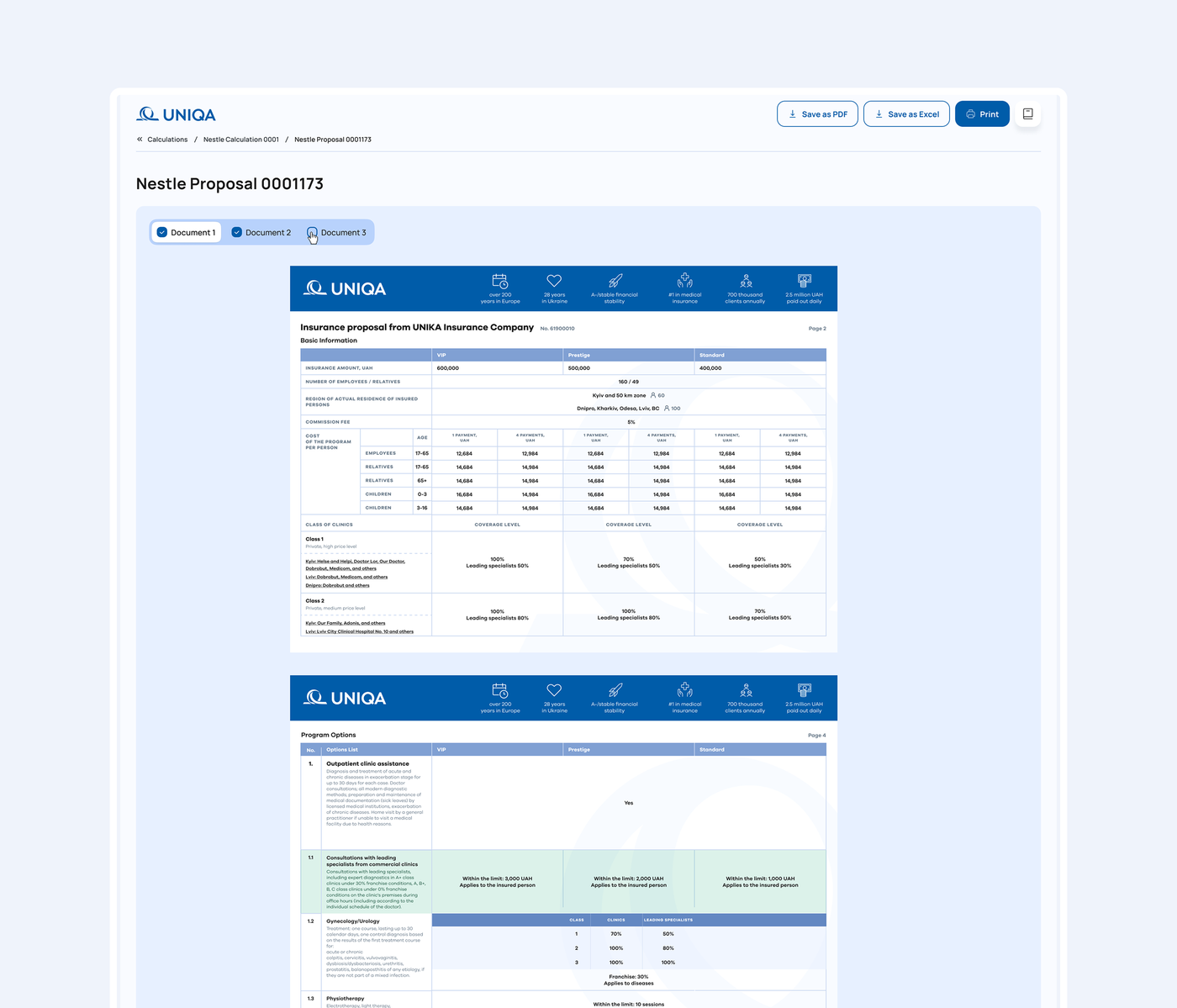

Client proposal

Once all calculations are created and verified, the proposal can be exported as a clean, accessible file in either DOC or Excel format, ready for client approval.

Integrations

Related services

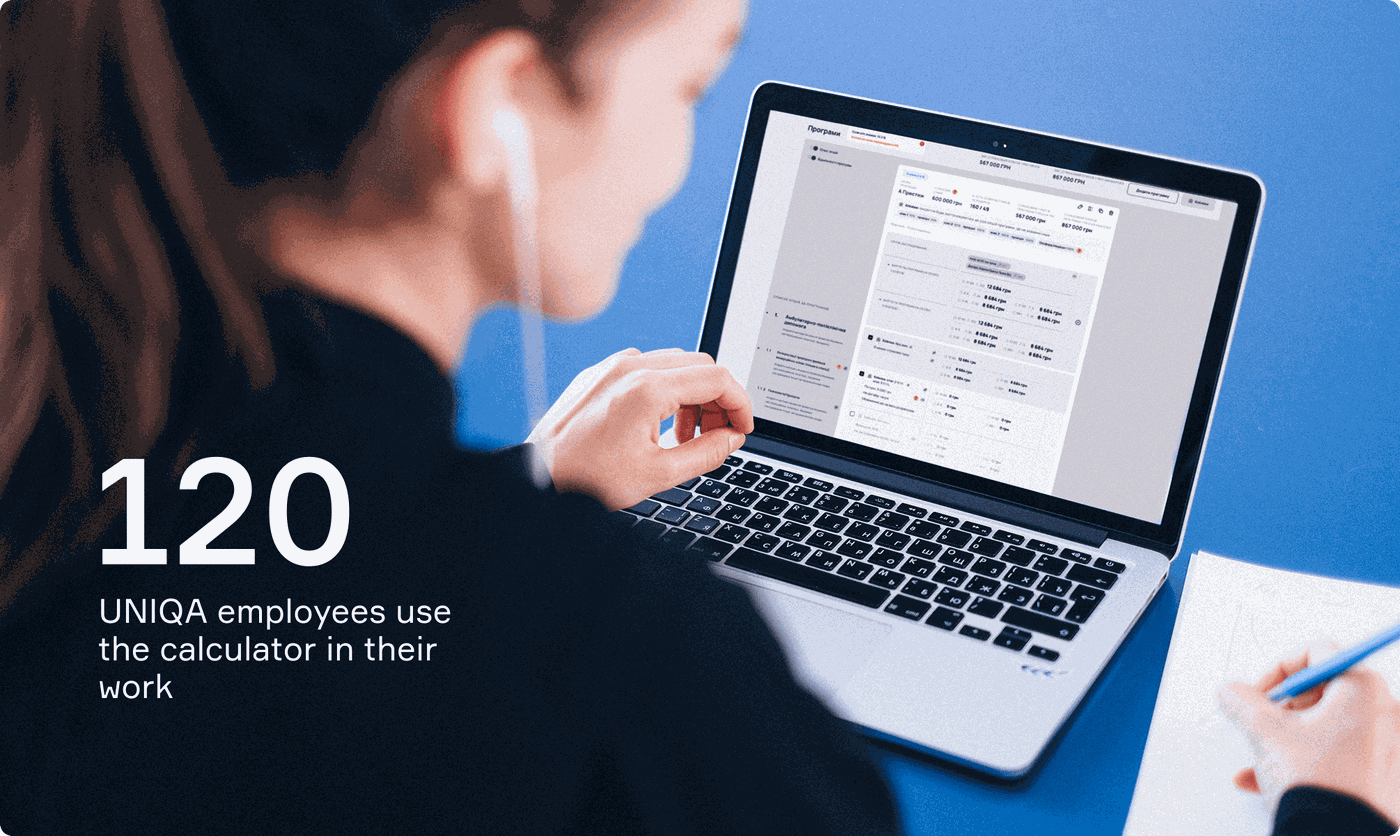

Impact

The new calculator transformed UNIQA's workflow by streamlining policy proposal analysis, comparison, and preparation. With built-in approval mechanisms, the team no longer needed external communication channels, which significantly cut decision-making time, minimized manual work and reduced potential errors. This more flexible, precise, and user-friendly financial tool boosted team efficiency and also strengthened UNIQA's client trust through faster, more accurate insurance quotes.

Thank you, UNIQA, for a truly unique experience!

Request a quote.

Thanks for scrolling this far. Let's take the next step. Provide us with a brief description of what you are going to build.