What Is a SaaS Business Model? Types, Revenue & Examples

Sooner or later, software founders face a similar dilemma: how do you turn a product into predictable, recurring revenue? The software as a service business model has made this task easier by shifting from one-time licenses to subscriptions, but that's just the surface. The real complexity lies in choosing the right revenue structure, pricing strategy, and operational model able to scale.

Yes, the SaaS business model can get you predictable cash flow, but you're also constantly fighting churn. You can scale quickly, but unit economics can make or break you. You attract investors with growth potential, but profitability often takes years.

Whether you're validating a SaaS idea, refining your monetization strategy, or scaling an existing platform, this guide walks you through the practical decisions that matter. Relying on our experience in SaaS development, we cover different types of SaaS business models, share how successful companies structure their SaaS revenue models, and highlight real examples of what works (and what doesn't).

Key takeaways

The SaaS business model entails an ongoing service relationship built on recurring subscriptions, where revenue compounds through the equation: Acquisition × ARPU - Churn.

Successful SaaS companies usually layer multiple revenue streams — subscriptions, implementation fees, transaction fees, and professional services — to reduce dependency on subscriptions alone.

Your pricing model choice should depend on average contract value: below $5K ACV favor self-service for ACV below $5K, use hybrid sales for $5K-$50K, and invest in dedicated sales teams when ACV is above $50K.

Common monetization mistakes include underpricing to drive volume, ignoring unit economics, and neglecting expansion revenue that costs 5–25x less than new customer acquisition.

The SaaS customer journey (Acquisition → Activation → Adoption → Retention → Expansion) requires excellence at every stage, as breaking down at any point threatens the entire revenue stream.

What is a SaaS business model?

A SaaS business model centers on hosting software in the cloud and providing access through subscriptions rather than one-time purchases. Instead of customers buying licenses and installing software on their own servers, they pay recurring fees (monthly or annually) to access your platform through the internet.

The SaaS operating model differs from traditional licensing in three fundamental ways:

Ownership and deployment work differently since the vendor maintains ownership, hosts the application, and handles all infrastructure;

The payment structure shifts from large upfront costs to smaller, recurring amounts;

Maintenance responsibility falls entirely on the SaaS provider, meaning customers always access the latest version without manual updates.

At its core, the SaaS business model transforms software from a static product into a service relationship. The basic revenue equation looks like this:

Revenue = Acquisition × ARPU - Churn

Here, acquisition represents how effectively you convert prospects into paying customers, ARPU (Average Revenue Per User) shows the average revenue generated per account, and churn indicates the percentage of customers who cancel subscriptions.

For example, if your product has a 3% monthly churn rate, each customer's expected lifetime is roughly 33 months (1 ÷ 0.03). With a $50 monthly subscription, that's $1,650 in lifetime revenue per customer. Small improvements in any of these metrics compound significantly over time.

How do SaaS companies make money?

SaaS companies generate revenue primarily through recurring subscriptions. Yet, the most successful SaaS business models involve layering multiple income streams to maximize profitability. Understanding these revenue mechanics helps explain why the model attracts so much investment.

Customers pay monthly or annually for continued access. Calculate revenue as: customers × average subscription price. For example, 500 customers × $100/month = $50,000 MRR ($600,000 ARR).

Additional revenue streams many SaaS companies utilize include:

Implementation fees: $1,000-$50,000+ for setup and configuration;

Professional services: Consulting, training (10-30% of revenue for enterprise companies);

Transaction fees: Percentage of transaction volume for products facilitating payments or bookings;

API and integration fees: Charges for premium access.

How does it work in practice? Let’s take a look at a SaaS reservation system charging $99/month, plus $1 per reservation. This generates $1,099 monthly from a restaurant doing 1,000 bookings. The transaction fees scale with customer success.

Revenue compounds through this equation:

New Revenue = (New Customers × ARPU) + (Expansion Revenue) - (Revenue Lost to Churn)

Here's a practical example. Starting with $25,000 MRR, next month you add 50 customers ($2,500), 25 customers upgrade ($625), and 15 churn (-$750) = $27,375 MRR (9.5% growth). Compound this monthly, and you see why retention matters. A 5% monthly churn rate means losing half your customers annually — requiring constant acquisition just to stay flat.

Expansion revenue is critical. Net Revenue Retention (NRR) above 100% means you're growing revenue from existing customers faster than losing it to churn:

NRR = (Starting ARR + Expansions - Contractions - Churn) ÷ Starting ARR

From our experience in SaaS technology consulting and development, the real power of the software-as-a-service revenue model lies in its compounding nature. When you balance acquisition, retention, and expansion effectively, each customer cohort becomes more valuable over time, creating a sustainable growth engine.

Benefits and challenges of SaaS models

The advantages of SaaS business model extend beyond just recurring revenue; however, they also come with operational realities that traditional software companies have never faced. Let's examine what makes this approach appealing and identify the real challenges it presents.

Benefits of a SaaS business model

Predictable revenue streams: Subscription models create cash flow forecasting that traditional software sales can't match. Instead of asking customers for $10,000 upfront, you're asking for $50 per month, which dramatically reduces decision-making friction.

Lower infrastructure costs: Customers don't need to maintain servers, hire IT staff for updates, or worry about hardware failures.

Scalability and flexibility: You can adjust infrastructure based on demand, add features continuously, and serve customers across different segments without separate product versions.

Protection against piracy: Cloud-based software is inherently harder to pirate than downloadable applications, protecting your intellectual property and revenue.

Investor appeal: The subscription model, combined with high retention rates and lower customer acquisition costs, creates exponential growth potential. Therefore, it’s only logical that SaaS remains the most prominent investment category in venture capital, with nearly half of global VC investment going to SaaS tech companies.

Challenges in SaaS operations

Continuous churn management: Unlike one-time sales, you need to earn customer loyalty continuously. A 5% monthly churn rate means you lose half your customers in a year, making retention as critical as acquisition.

Cash flow gaps: You typically spend money on marketing, sales, and infrastructure before seeing returns, creating a strain that can challenge early-stage companies.

Multi-tenancy complexity: Serving multiple customers on shared infrastructure while maintaining data isolation, security, and performance requires sophisticated architecture.

Data security and compliance: You're responsible for protecting customer data across jurisdictions with varying regulations like GDPR, CCPA, and HIPAA. A single breach can irreparably damage trust.

Competitive pressure: The lower barriers to entry that benefit customers also mean more competition, requiring either exceptional execution or finding an underserved niche.

Types of SaaS business models

Subscription-based SaaS

The most common business model SaaS companies use involves straightforward recurring payments. Customers pay a fixed fee for continued access. This works well when your product provides consistent value, usage doesn't vary dramatically, and you want predictable revenue. The challenge is proving value all the time — if customers don't use your product, they'll cancel.

Freemium SaaS

Freemium offers a free tier with limited features, with paid upgrades for advanced functionality. This is one of the most popular software-as-a-service models for building user bases quickly. Dropbox, Slack, and Trello have successfully utilized freemium models. However, conversion rates from free to paid typically range from 2% to 7%, meaning you need a significant volume. Plus, you must be ready to support a large free user base that never converts.

Pay-as-you-go SaaS

Usage-based pricing charges customers based on consumption — API calls, storage used, transactions processed. AWS, Twilio, and Stripe are prominent pay-as-you-go SaaS business model examples. Customers appreciate paying only for what they use, reducing commitment fears. The challenge here is revenue unpredictability and the need for robust metering infrastructure.

Hybrid SaaS models

Many businesses combine elements from different types of SaaS business models:

Tiered subscription + usage: Base subscription with usage-based overages

Freemium + subscription tiers: Free basic version with multiple paid tiers

Subscription + add-ons: Core subscription with optional premium features

Per-user + feature tiers: Pricing based on users with different feature sets

HubSpot employs a hybrid model effectively, offering a free CRM with paid tiers that combine user limits, feature access, and usage-based elements.

Types of SaaS revenue models

Monthly Recurring Revenue (MRR) model

MRR focuses on predictable monthly income from subscriptions. This SaaS revenue model provides clear month-over-month growth tracking. To calculate MRR, you need to multiply total active customers by average monthly subscription fee: 500 customers × $100/month = $50,000 MRR. This approach works well for early-stage startups that require frequent cash flow and rapid feedback loops.

Annual Recurring Revenue (ARR) model

ARR calculates predictable yearly income, typically used once you reach a significant scale (above $1-2M in revenue). This software-as-a-service revenue model emphasizes longer-term customer relationships. Annual contracts improve cash flow but can mask engagement issues until renewal time.

Tiered pricing model

Tiered pricing offers multiple subscription levels with increasing features and capacity. This is among the most common SaaS monetization models because it captures value across different customer segments. Here is what the typical structure looks like: basic (essential features, lowest price), professional (advanced features, mid-range), enterprise (full features, custom pricing).

Usage-based revenue model

Usage-based pricing charges based on actual product usage. This revenue model SaaS companies use aligns costs with the value received. Common metrics include API calls, storage capacity, transactions processed, and compute resources. The model reduces friction for new customers but creates revenue variability.

Per-user pricing model

Per-user pricing charges based on the number of accounts or active users. This SaaS revenue model scales directly with customer team size. It’s simple to understand, and the revenue grows with customer teams. As for drawbacks, it can discourage wider adoption, and doesn't capture value differences between high and low usage.

Value-based pricing model

Value-based pricing ties costs to outcomes your product delivers rather than features. If your software saves customers $100,000 annually, pricing at $30,000 makes ROI clear. Works best for products with quantifiable business impact and enterprise markets. The challenge is accurately quantifying value across different customer types.

How to select a SaaS pricing model?

Choosing the right pricing approach is fundamentally about aligning your model with your product value, target market, and business objectives. Here's a practical framework for making this decision.

Start with your customer's perspective

Before looking at pricing models, understand how your customers think about value. If you're saving time, can you quantify hours? If you're generating revenue, can you tie pricing to that outcome? Consider how they budget — startups prefer monthly commitments, enterprises budget annually. Understanding usage patterns matters: consistent daily use suggests subscription pricing, sporadic high-volume usage points toward pay-as-you-go.

Match pricing to your product characteristics

For products with network effects, freemium works well. For products with capacity constraints, tiered pricing captures value across different scales. Products with variable usage work better with usage-based pricing. For products with distinct feature sets, feature-based tiers help customers self-select.

Consider your business stage

Your pricing strategy should evolve as your company matures, striking a balance between immediate needs and long-term positioning.

| Business stage | Pricing focus | Key actions |

|---|---|---|

| Early (0-2 years) | Validation & learning | Simple pricing, extended trials, and monthly billing |

| Growth (3-5 years) | Revenue scaling | Annual discounts, multiple tiers, and expansion opportunities |

| Mature (5+ years) | Margin optimization | Value-based segmentation, enterprise tiers |

Test and refine systematically

Pricing isn't permanent, so you need to track the metrics that reveal whether it's working: conversion rate from trial to paid, average contract value, time to first paid conversion, upgrade and downgrade rates, and customer lifetime value by acquisition channel. These indicators show whether your pricing supports sustainable growth or creates friction.

We also recommend running A/B tests for new customers while grandfathering existing ones. Test one variable at a time — price point, tier structure, or billing frequency. Survey customers about their feature priorities and how they perceive your pricing compared to alternatives. Start with 2–3 tiers, maximum, and avoid underpricing due to insecurity. Ensure your pricing supports CAC payback periods of 12 months or less.

Ultimately, your pricing model serves as a communication tool that conveys to customers what you believe your product is worth and for whom it's intended. Start simple, measure customer behavior, and refine based on real data rather than assumptions.

Common mistakes in SaaS monetization: How to avoid them?

Pricing mistakes can quietly erode your growth for months before you notice — and by then, they're harder to fix. Here are the patterns that trip up even experienced founders when implementing SaaS monetization models.

Underpricing to drive volume

Setting prices artificially low to attract customers backfires by bringing in price-sensitive buyers who churn quickly and demand disproportionate support. You train the market to undervalue your product and create a CAC-to-LTV ratio that makes growth unprofitable. Set up the price based on value delivered, not costs or competitor minimums — you can always discount, but raising prices on existing customers damages trust.

Ignoring unit economics

A $10/month product with $200 customer acquisition cost needs 20 months to break even, assuming zero churn. This strains cash flow and investor confidence while you grow. Calculate your unit economics before finalizing pricing — CAC payback under 12 months and LTV:CAC ratio of at least 3:1 for healthy businesses.

Too many pricing tiers

Offering 5–6 tiers creates decision paralysis where customers compare options instead of buying, while support complexity increases and messaging gets diluted. Start with 2–3 tiers maximum with clear differentiation, and add more only when data shows a distinct segment's needs aren't met.

Poor feature distribution

Withholding essential functionality from lower tiers frustrates customers, while failing to reserve compelling features for higher tiers leaves money on the table. Make your basic tier fully functional for its intended use case. Premium features should be “nice-to-have” for small users but “must-have” for larger customers.

Neglecting expansion revenue

Focusing only on initial subscription value ignores the reality that acquiring new customers costs 5–25 times more than expanding existing ones. Among SaaS business model challenges, missing expansion revenue is particularly costly because it forces you to rely solely on new customer acquisition for growth. Build expansion paths through tier progression, add-on features, usage-based components, and professional services that grow with customer success.

Changing prices without grandfathering

Raising prices on existing customers without notice damages trust immediately, increases churn, and generates negative word-of-mouth. Give 60-90 days notice and consider grandfathering customers at current rates. This means allowing existing customers to keep their original pricing permanently or for an extended period. If raising prices for everyone, explain the added value clearly and offer annual commitments at old rates.

SaaS operating and sales models

Unlike traditional software with a single transaction, the software-as-a-service operating model creates an ongoing relationship with distinct phases: Acquisition → Activation → Adoption → Retention → Expansion. Each phase requires different strategies and resources, and breaking down at any point threatens the entire revenue stream.

Acquisition models

How you acquire customers shapes your entire operation and depends largely on your average contract value:

Self-service (product-led growth) means customers sign up without sales interaction. This works best for products with clear, immediate value and a simple setup. Examples include Calendly, Notion, Airtable.

Sales-assisted (hybrid) lets customers start self-service but request sales support. It combines scalability with higher-value conversions. Examples are HubSpot, Intercom, Zendesk.

Enterprise sales (sales-led) involves direct sales teams with 3-12 month cycles and high touch. Justified by large contract values. Examples include Salesforce, Workday, ServiceNow.

Last but not least, your B2B SaaS sales model choice depends heavily on average contract value, product complexity, and target market. As a general guideline, if your ACV is below $5K, favor self-service to keep acquisition costs low and leverage product virality. Between $5K-$50K ACV, use a hybrid approach and let customers start independently but provide sales assistance for complex deals. Above $50K ACV, invest in sales-led motion with dedicated account executives, as contract value justifies the high-touch approach.

Enterprise SaaS vs. B2B SaaS models

While both serve business customers, enterprise SaaS and B2B SaaS business models differ significantly in approach, requirements, and operations. The fundamental differences start with who you're selling to and how much they're willing to pay. B2B SaaS typically targets small to mid-sized businesses, where decisions happen quickly and buyers need solutions that work out of the box. Enterprise SaaS focuses on large organizations with complex requirements, multiple stakeholders, and longer evaluation processes.

| Aspect | B2B SaaS | Enterprise SaaS |

|---|---|---|

| Contract value | $1,000–$50,000 annually | $50,000–$1M+ annually |

| Sales cycle | Days to weeks | 3–12 months |

| Decision makers | Department heads | C-level, procurement |

| Pricing | Transparent, published | Custom quotes |

| Product focus | Quick time-to-value, intuitive UI | Security (SSO, SAML), compliance (SOC 2, GDPR) |

| Go-to-market | Product-led growth, self-service | Field sales, custom demos, procurement |

| Support | Email/chat | 24/7 with SLA, dedicated CSM |

Customer success and revenue patterns also reflect the differences. B2B uses automated onboarding and low-touch CSMs managing 100–500 accounts, while enterprise dedicates CSMs to 10–50 accounts with quarterly business reviews. B2B SaaS typically shows faster growth, with 3-7% monthly churn and 3-12 month payback periods. Enterprise grows more slowly initially but delivers 110-150%+ net revenue retention with stickier customers, thanks to deeper integration and higher switching costs.

The B2B SaaS business model works great when your product solves specific problems quickly with straightforward implementation. The enterprise SaaS business model, on the other hand, requires addressing complex, mission-critical needs with rigorous compliance requirements. Many successful companies start as B2B and move upmarket over time, serving SMBs in years 1-2, adding enterprise features in years 3-4, and establishing dedicated enterprise divisions by year 5 and beyond.

SaaS business model examples

Seeing how successful companies structure their revenue models provides valuable context for the concepts we've discussed. Here are some examples showing different approaches to monetization and growth.

Slack: Freemium to enterprise

Slack uses a freemium model with tiered subscriptions. The free plan includes a 90-day message history. Pro starts at $7.25/user/month (annual billing) with unlimited history, Business+ at $15/user/month (annual) adds SSO and advanced controls, and Enterprise Grid offers custom pricing for large organizations.

Slack follows a product-led growth strategy: teams start free, upgrade as they scale, and benefit from network effects that drive organic adoption.

Salesforce: Platform and ecosystem

Salesforce spans multiple product lines — Sales Cloud, Service Cloud, Marketing Cloud — each with tiered pricing from around $25 to $330+ per user/month depending on features. Its AppExchange marketplace powers an extensive ecosystem of integrations.

The revenue strategy focuses on landing with one product, expanding into additional clouds, and layering professional services. Multi-year contracts create predictable renewals and strong customer retention.

Stripe: Usage-based with premium tiers

Stripe operates on a transparent usage-based pricing model: 2.9% + $0.30 per transaction for standard card processing, with no monthly fees. Premium tools like Billing, Connect, or Radar use separate usage-based pricing. As customers’ transaction volumes grow, so does Stripe’s revenue, aligning its success directly with that of its users.

HubSpot: Freemium plus product bundling

HubSpot offers a free CRM to attract users into its ecosystem, with paid Hubs sold separately or bundled. Marketing Hub starts at $890/month (Professional) and scales to $3,600/month (Enterprise). Sales Hub starts at $90/user/month and reaches $150/user/month for Enterprise. Bundles like the CRM Suite provide cross-product discounts.

This model encourages businesses to start free and upgrade as their needs expand.

Brights experience: Showcase's hybrid revenue model

At Brights, we've also seen these principles work in practice through our own SaaS development projects. One case that illustrates the complexity of building a monetization-first platform is Showcase, which we helped launch in 2024.

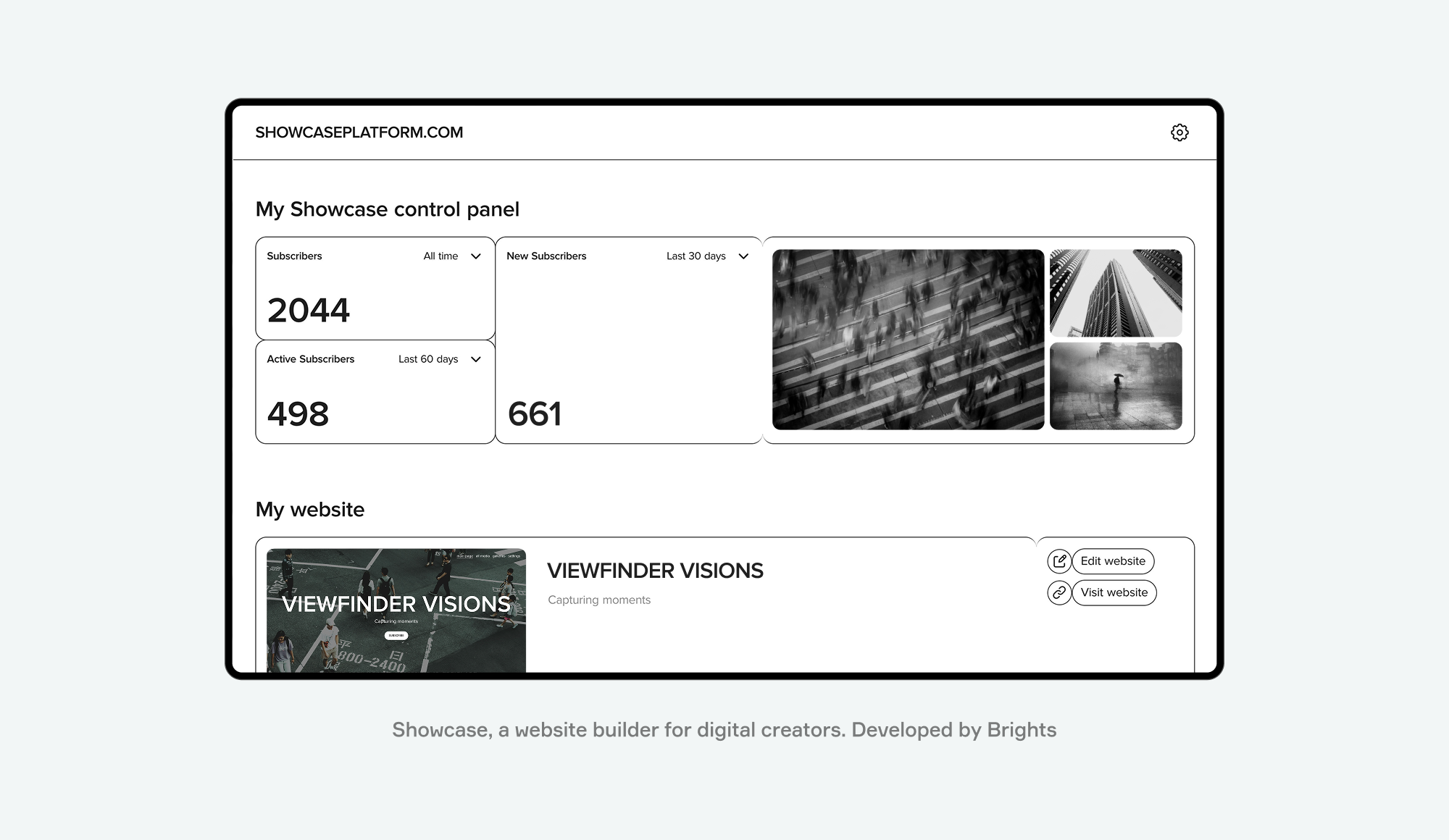

Showcase, a website builder for digital creators. Developed by Brights

Showcase is a specialized website builder designed for photographers and visual creators who needed a platform to share their work securely while maintaining control over their intellectual property.

Working closely with the client, Brights developed a comprehensive creator platform featuring custom portfolio builders, per-user digital watermarking through IMATAG integration, and integrated Stripe-based subscription systems. The watermarking technology became the platform's differentiator, enabling creators to track leaked content and identify who shared it. Combined with locked content functionality and pay-per-view options, Showcase gave creators multiple ways to monetize their work while protecting it.

The platform's revenue model combines tiered subscription pricing with transaction fees — a hybrid SaaS monetization approach. It offers three tiers:

Secure ($40/mo): Allows to share up to 1,000 images and videos with 200 GB storage, provides unique digital watermarking and leak tracing services, and 15% processing fee on in-app purchases;

Secure Pro ($80/mo): Increases capacity to 2,500 images and videos with 500 GB storage, reduces processing fees to 10%, and adds leak recovery enforcement of up to $2,000 per violation plus scheduled publishing;

Enterprise ($300/mo): Scales to 10,000 images and videos with 2.5 TB storage, lowers processing fees to 8%, and provides leak recovery enforcement of up to $10,000 per violation.

Results validated the model quickly: even before official launch, Showcase attracted its first creators in the first month, with one gaining 237 subscribers (99% conversion to paid). The watermarking system successfully identified the first cases of leaked photographs, proving the core value proposition worked.

SaaS business model innovation in 2025

The SaaS landscape continues to evolve rapidly, introducing new patterns that challenge traditional subscription models. Understanding these trends helps you identify opportunities competitors might miss.

AI-native SaaS products

New wave of AI SaaS startups is building products where AI replaces workflows entirely. AI SDRs that autonomously prospect, AI customer support agents handling full resolution, and AI code generation tools are just a few examples.

Business model implications are shifting accordingly. Value-based pricing that charges for outcomes is becoming more relevant, usage-based models align better with AI compute costs, and per-task pricing is replacing traditional per-user subscriptions.

Vertical SaaS dominance

Vertical SaaS — deep solutions for specific industries — is winning with less competition in niche markets, premium pricing for industry-specific features, and better unit economics. Toast (restaurant POS), Procore (construction), and Veeva (pharmaceutical) exemplify this approach.

These solutions can be characterized by premium pricing, embedded payments or marketplace transaction fees, industry-specific compliance built in, and higher customer lifetime value.

Usage-based pricing resurgence

Usage-based models are gaining traction because they offer better alignment between costs and value, reduce commitment friction for new customers, and address customer resistance to per-user pricing that discourages adoption. Snowflake, Twilio, Vercel, and OpenAI have successfully implemented this approach.

The challenges include decreased revenue predictability and more difficult forecasting, which requires more sophisticated financial planning.

Consolidation and platform plays

Companies are bundling previously separate products into integrated platforms. HubSpot is expanding from marketing into sales and service, while Monday.com is moving from project management into CRM territory.

The advantages are higher revenue per customer, increased switching costs, better data integration. The main risk is becoming “good at everything, great at nothing” and losing the focus that initially drove success.

Conclusion & next steps

The SaaS business model has fundamentally changed how software creates value. Moving from one-time licenses to ongoing subscriptions transforms software from a product into a relationship, where continuous value delivery becomes the foundation of revenue.

When building a SaaS product, a few principles stand out. Pricing that aligns with value makes sales easier and improves retention. Investing in retention matters as much as acquisition — churn undermines growth. Starting simple and evolving based on customer behavior works better than premature optimization. Your model should match your resources and market reality. Most critically, understanding unit economics early — CAC, LTV, payback periods, retention rates — tells you whether your business model is sound before you scale.

At Brights, we've worked with companies from MVP validation to scaling mature platforms. We understand the unique demands of SaaS development — whether you need technical expertise, process optimization, or team augmentation. If you're considering your next steps, reach out for assistance with concept validation, discovery, MVP development, or scaling infrastructure.

FAQ.

The main challenges of choosing a SaaS business model include ensuring data security, managing multi-tenancy complexity, maintaining regulatory compliance, and achieving scalability. Customer acquisition and retention are also ongoing challenges that require continuous effort in any SaaS operating model